Are Software Downloads Taxable In Florida

May 08, 2021 ・0 comments

Are Software Downloads Taxable In Florida. Lists of what goods are taxable and what are not may be voluminous. A Florida sales tax lawyer from Law Offices of Moffa, Sutton, & Donnini, P.

![TurboTax Deluxe 2019 Tax Software [Amazon Exclusive] [Mac ...](https://images-na.ssl-images-amazon.com/images/I/51oPhCiF8FL.jpg)

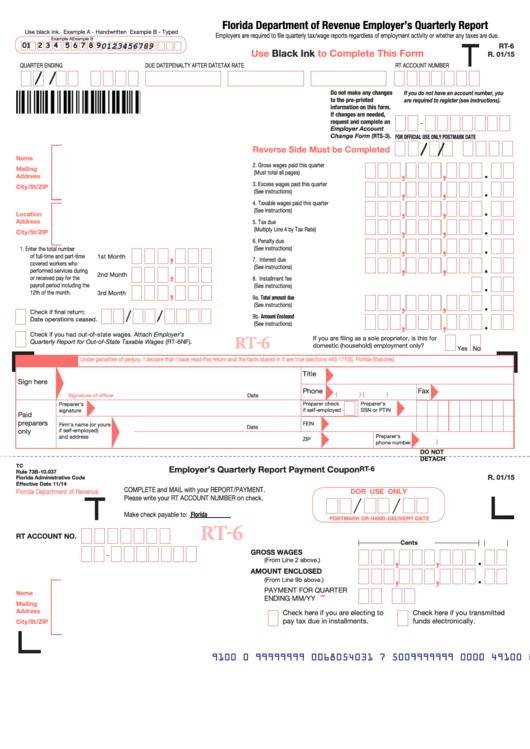

In the state of Florida, software which is used mainly for research and development may Sales of canned software - downloaded are exempt from the sales tax in Florida.

It helps you to prepare regular & correction e-TDS Your actual tax liability would be calculated on the total taxable income.

Perhaps your business is headquartered in the Sunshine State, or you have a remote employee working from the state, or inventory stored in a warehouse there. The tax usually covers the entire price paid by the purchaser Individual counties in Florida apply a varying sales surtax, known informally as a county tax, on transactions that qualify for the state sale tax. With software, taxability generally depends on whether the software is canned or custom, downloaded or delivered on.

Post a Comment

If you can't commemt, try using Chrome instead.